This guide delves into personal payment authorization letters, explaining their purpose, structure, and key components. It offers insights on drafting effective authorization letters for various transactions, ensuring clarity and security in financial agreements.

In today's fast-paced world, personal payment authorization letters have become an integral part of financial transactions. These letters serve as legal documents that grant permission to someone else to make payments on your behalf. Whether you are traveling, incapacitated, or simply need someone to manage your financial affairs, a personal payment authorization letter ensures that your financial obligations are met promptly and securely. In this article, we will delve into the essentials of personal payment authorization letters, their importance, and how to draft one effectively.

What is a Personal Payment Authorization Letter?

A personal payment authorization letter is a written document that grants someone else the authority to make payments on your behalf. This letter is typically used when you are unable to make payments yourself due to various reasons, such as travel, illness, or other personal commitments. The person authorized to make payments, often referred to as the agent, will have the authority to pay bills, withdraw funds, or perform other financial transactions on your behalf.

Importance of a Personal Payment Authorization Letter

1、Security: A personal payment authorization letter ensures that your financial transactions are conducted securely. By granting authority to a trusted individual, you can rest assured that your financial affairs are in good hands.

2、Accountability: The letter establishes a clear agreement between you and the authorized person, outlining their responsibilities and limitations. This helps in maintaining accountability and transparency in financial transactions.

3、Efficiency: In situations where you are unable to make payments yourself, a personal payment authorization letter allows the authorized person to act on your behalf, ensuring that your financial obligations are met promptly.

4、Legal Protection: In case of disputes or misunderstandings, a personal payment authorization letter serves as a legal document that can be used to prove the authority granted to the agent.

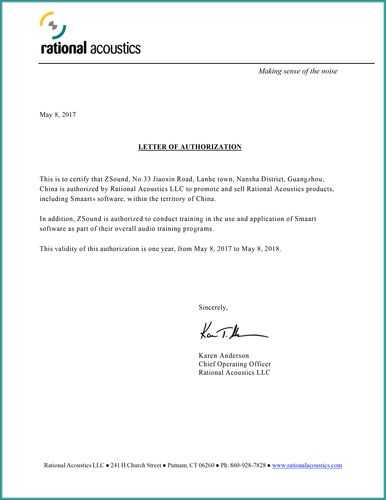

How to Draft a Personal Payment Authorization Letter

1、Begin with a formal heading: Include the date, your name, and the name of the authorized person at the top of the letter.

2、Introduce the purpose: Clearly state the reason for drafting the letter, such as travel, illness, or other personal commitments.

3、Grant authority: Specify the type of payments the authorized person is permitted to make. This may include paying bills, withdrawing funds, or performing other financial transactions.

4、Define limitations: Outline any restrictions or limitations on the authorized person's authority. For example, you may specify that they can only make payments up to a certain amount or for specific purposes.

5、Provide instructions: Include any additional instructions or guidelines for the authorized person, such as contacting specific individuals or agencies for further information.

6、Sign and date: Sign the letter in the presence of a witness, if required by your financial institution. Date the letter to establish the validity of the authorization.

7、Attach necessary documents: If required, attach copies of identification or other documents to support the authorization.

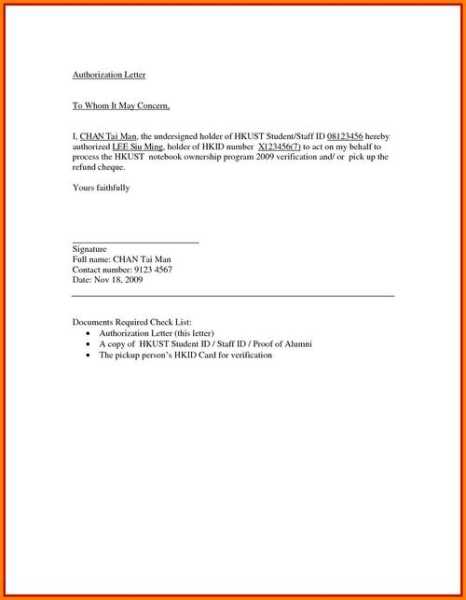

Sample Personal Payment Authorization Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Authorized Person's Name]

[Authorized Person's Address]

[City, State, ZIP Code]

Subject: Personal Payment Authorization

Dear [Authorized Person's Name],

I, [Your Name], hereby authorize [Authorized Person's Name] to make payments on my behalf due to [reason for authorization]. The following instructions outline the scope of this authorization:

1、[Authorized Person's Name] is permitted to pay my monthly utility bills, including electricity, water, and gas, up to a maximum amount of $500 per month.

2、[Authorized Person's Name] is authorized to withdraw funds from my savings account to cover these expenses.

3、[Authorized Person's Name] is required to provide receipts or proof of payment to me upon request.

Please note that this authorization is valid until [expiration date]. Should you require further information or assistance, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

I trust that [Authorized Person's Name] will act responsibly and diligently in managing my financial affairs. Thank you for your cooperation.

Sincerely,

[Your Name]

[Your Signature]

[Date]

Remember, personal payment authorization letters should be used with caution and only granted to trusted individuals. Always review the letter carefully before signing, and keep a copy for your records.

相关阅读:

1、Step-by-Step Guide to Crafting an Export Authorization Letter with a Complete English Template

2、Comprehensive English Sample: Crafting a Payment Authorization Letter

3、Step-by-Step Guide to Writing a Personal Remittance Authorization Letter in English

4、Decoding Authorization Letters: Mastering the Art of Power of Attorney Documents

Mastering the Personal Payment Authorization Letter: Your Ultimate Guide

Mastering Personal Payment Authorization Letters: Your Ultimate English Guide

Decoding the Personal Payment Authorization Letter: Your Ultimate English Guide

Decoding the Personal Payment Authorization Letter: Your Ultimate Guide

Mastering the English Personal Payment Authorization Letter: A Comprehensive Guide

Navigating Personal Payment Authorization Letters: Your Ultimate Guide

Mastering the Art of Writing a Payment Authorization Letter: Your Ultimate English Template Guide